Import and export trade compliance

|

Import and Export License The import and export license is an important administrative license document for the state to manage the import and export of goods. It is not only a certificate for enterprises to legally import and export, but also an important basis for supervision by departments such as the customs. Holding a license can ensure compliance in trade, safeguard national security and interests, regulate market supply and demand, and promote the development of foreign trade. Therefore, for enterprises engaged in import and export business, it is crucial to apply for and properly keep the import and export license in a timely manner.

|

|

1. Why apply for an import and export license? Applying for an import and export license is to ensure the legality and standardization of import and export activities, and to maintain national economic security and trade order. It is not only a necessary qualification for enterprises or individuals to participate in international trade, but also an important basis for customs supervision, foreign exchange management, tax collection, etc. It helps to promote the healthy development of foreign trade and safeguard national economic security and interests. |

|

|

|

|

|

2. What are the conditions for applying for an import and export license? Products that the customs allows to be imported and exported, and enterprises that possess the qualifications required for engaging in import and export business. |

| 3. How to apply for it? Prepare materials: The applying unit or individual (license applicant) prepares relevant application materials, including written application letters, specific information of the exported goods, and relevant certificates or materials (such as the original contract, approval documents from the competent department, etc.). Submit the application: Submit the prepared application materials to the licensing authority, usually through an online application platform or on-site submission. Examine the materials: After receiving the application materials, the licensing authority examines the materials to ensure that the application content is true, accurate, and in line with relevant laws, regulations and provisions. Computer entry: If the application meets the requirements after examination, the licensing authority will enter all the contents of the application form into the computer system for subsequent management and tracking. Issue the license: After the examination is passed, the licensing authority will issue the "Export License of the People's Republic of China" in multiple copies, which will be held by the license applicant and used for handling the export declaration of goods with the customs and the foreign exchange settlement procedures with the bank. |

|

|

4. Our business items ① Import/export license ② Certificate of origin issued by the customs, Certificate of origin issued by the China Council for the Promotion of International Trade ③ Dangerous goods packaging certificate ④ Automatic import license ⑤ Import and export license for technologies ⑥ Import and export license for dual-use items and technologies ⑦ Business license for Class III medical devices ⑧ Business license for hazardous chemicals ⑨ Road transport license ⑩ Business license for publications ⑪ Business license for tourism services ⑫ Food business license ⑬ Wholesale license for alcoholic products ⑭ Business license for pesticides (non-restrictive) |

|

5. Points for attention when applying for an import and export license ① The conditions and time for applying for licenses for different products vary. |

|

| Shenzhen Yudashun Supply Chain Co., Ltd. focuses on foreign trade services. With twenty years of experience in agency services, a professional team, and efficient handling, it saves time and worry. If you have any needs for applying for licenses, you can contact us. We will customize solutions to help you smoothly import and export and start your trade journey. | |

|

Documents, customs declaration and clearance Documentary customs declaration refers to the procedures and steps that the consignor and consignee of import and export goods, the person in charge of transportation, the owner of the goods or their agents go through for the entry and exit of goods, articles, means of transportation and related customs affairs in accordance with the regulations of the customs.

|

|

1. Documents Required for Customs Declaration ①. Import and Export Contract: Clearly list in detail the terms such as the name, specification, quantity, and price of the goods. |

|

|

|

|

|

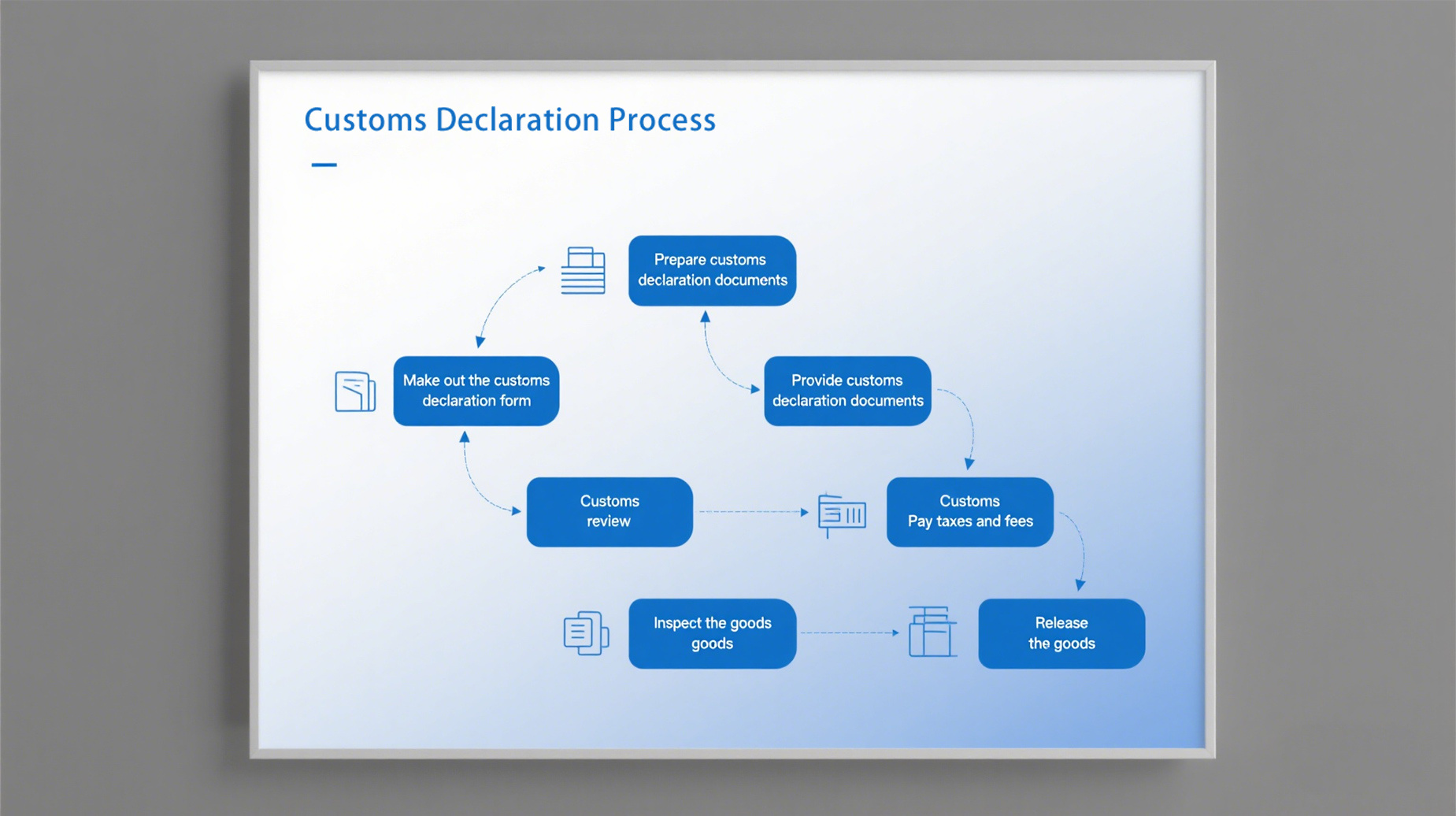

2. Customs Declaration Process ①. Prepare customs declaration documents ②. Make out the customs declaration form ③. Provide customs declaration documents ④. The customs examines the documents ⑤. Pay taxes and fees ⑥. Inspect the goods ⑦. Release the goods |

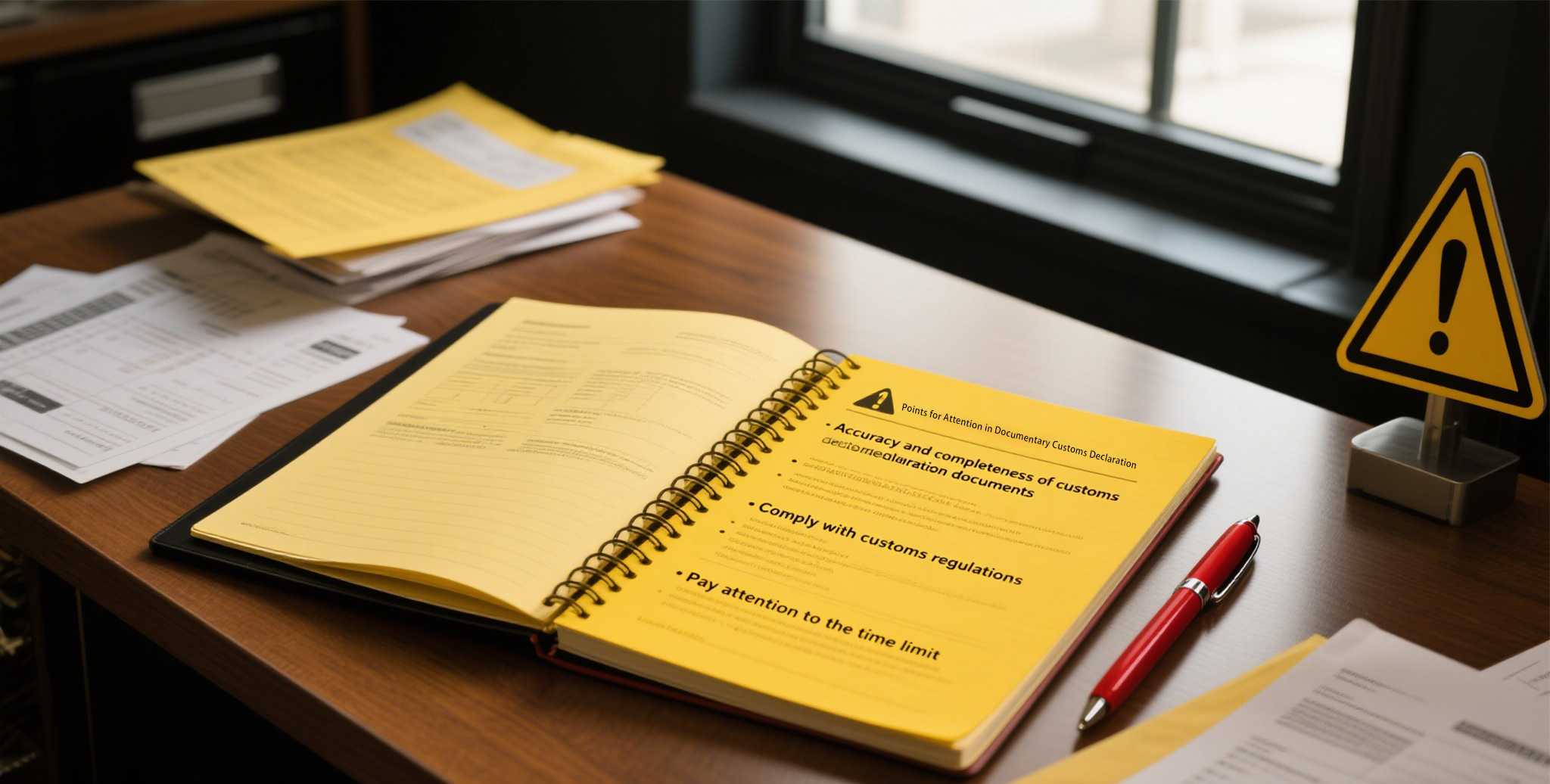

| 3. Points for Attention in Documentary Customs Declaration ①. Accuracy and Completeness of Customs Declaration Documents: The provided customs declaration documents must be accurate without any errors, and the customs declaration documents must be complete. ②. Comply with Customs Regulations and Laws and Regulations: It is necessary to have a detailed understanding of the customs regulations and laws and regulations of the destination country or region as well as the transit country to ensure that the declared goods meet the relevant requirements; the customs declaration documents and goods must be legal and compliant. ③. Pay Attention to the Customs Declaration Time Limit: The customs declaration period for imported goods is usually within 14 days as of the date when the means of transportation declares its entry into the territory. ④. Pay Attention to the Packaging and Marking of the Goods: The packaging of the goods must comply with the regulations and requirements of the customs; the goods should have clear markings. ⑤. Maintain Communication with the Customs: In case of any problems or questions, it is necessary to communicate with the customs in a timely manner and seek help; if the customs needs to inspect the goods, the enterprise should actively cooperate and provide necessary assistance. ⑥. Other Points for Attention: The documents should be consistent with each other, the documents should be in line with the goods, and keep the documents. |

|

| We have rich customs declaration experience and a professional team, and are able to customize the most suitable customs declaration plan for you. If you encounter any problems or need consultation during the customs declaration process, we will wholeheartedly provide you with help. | |